October Update

October 27, 2023Update

I hope you all enjoyed the “summer” we had. I have been meaning to write on a number of topics for some time now.

Before I begin, I wanted to extend my deepest sympathies to my Jewish clients and friends during this very challenging time. I hope you and your families are safe. My thoughts are with you and please let me know if there is anything I can do to support you.

Long Term Care

I wanted to inform you that I have been through the process to secure the Financial Conduct Authority (FCA) permissions so that the firm can now provide advice to clients at risk of moving into long term care. While I’ve been advising in this crucial area for many years, I wanted to ensure you were aware of this recent development. Navigating the complexities of long-term care planning is more important than ever. Our regulator (the FCA) regards this as a high-risk area of advice as there are so many moving parts in terms of protecting vulnerable clients, the interaction with state/local authority funding for care homes and the risk of hard-earned savings disappearing rapidly to pay for ever increasing care home fees.

This type of planning presents lots of opportunities to protect capital from both care fees and Inheritance Tax. As in most things, it is always better to seek advice as early as possible for the best results (ideally at least 3 years before care may be needed). If you know of anyone that may benefit from a consultation with me, please remember that I always hold the first meeting without charge, so it will cost them nothing to find out if I can help. I encourage families to attend these meetings together, provided, of course, it aligns with the parents’ wishes.

The FCA does not regulate Inheritance Tax Planning advice.

Inflation/Interest Rates

As far as markets are concerned the big story over the last few years has been inflation (increases in the cost of living). Our central banks, such as the Bank of England and the Fed in the US have a mandate to keep inflation around 2% and they use interest rates as their main lever to pull to keep them at the desired level. Without boring you with a long deep dive into economics, this can be a somewhat ponderous approach with the outcomes far from certain.

On the positive side, we are now seeing headline rates of inflation dropping which should mean that at some point interest rates should start coming down. Markets should respond positively to this as the underlying economies and companies will benefit from lower borrowing costs. The US are forecast to start cutting their rates by the middle of next year but anecdotally, I am hearing from mortgage advisers that they are already seeing rates coming down.

If the conflict in the middle east widens there is a possibility of inflation reductions being set back due to a rising oil price.

Is cash king?

I wanted to cover this as the question has been raised as to whether it is currently better to be invested or move to cash, as cash rates are now at their highest level for many years.

For my part, I do think that inflation and cash rates will normalise at around 3% over the next few years (barring any other outside events), so I do not believe the current high rates are here to stay.

It may be the case that in the very short-term, cash can seem appealing especially with markets being volatile over the last few years. However, there are several good reasons not to move out of the market.

- Cash is still returning far below the rate of inflation, so any cash held is an almost certain bet to lose its value over the next 12 months.

- Trying to time entry out of or into the market is a fool’s errand and even the highly paid professionals cannot do it on anything like a consistent basis. The mantra that applies here is ‘Time in the market, not market timing’. Most people end up selling after markets have fallen and then buying back once they have risen, whereas in nearly all cases it is better to have remained in the market and done nothing. Without wanting to get too technical here, there is a lot of evidence I can send to demonstrate this. If you are having trouble sleeping, please let me know and I will send it over.

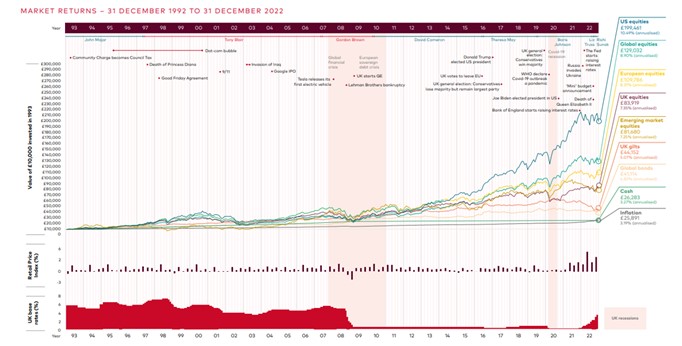

- One of my favourite mantra’s is ‘patience is bitter, but it’s fruit is sweet’. This definitely applies to investing where there is often a pressure to do something, whereas we know from history that markets are cyclical, and they reward patience not activity. To quote the legendary investor Warren Buffett ‘No matter how great the talent or efforts, some things just take time. You can’t produce a baby in one month by getting nine women pregnant’. If you take the chart below, you can see that inflation has averaged around 3% per year over the last 30 years whereas the average return on UK bonds has been 5% and 7% on UK equities. Global equities have averaged a 9% annual return. Obviously, no one has a crystal ball, and we don’t know what will happen next, but this is why I say that to beat inflation in the medium to long term, history tells us investing is this best way to do this.

(Source: Bloomberg, Factset and Bank of England, as at 31 December 2022.

I hope that explains my thinking in this area but please do let me know if you have any questions on this issue.

Equity investments do not afford the same capital security as deposit accounts. Your capital is at risk. The value of your investment (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

Cash Management

Speaking of cash and rising rates, I am aware that many of my clients need to hold onto large amounts of cash for a number of reasons, such as purchasing a property, paying their tax bills, or to fund big expenditure in the next year or two. The struggle always seems to be staying within the £85,000 Financial Services Compensation Scheme (FSCS) limits and keeping up with the decent rates. In the past, I provided specialist guidance to charities on how to invest their cash to maximise the yield but stopped in 2016 due to the terrible rates. As higher cash rates are likely to be around for the next few years, I have signed an agreement with Insignis cash to provide cash management facilities to my clients. This is designed for sums over £50,000 and not necessarily intended for rainy day funds which I usually recommend holding in NS&I Premium Bonds.

The benefits of using this service are:

- You only need to go through the process of opening one hub bank account. This can then be used to open linked accounts with up to 30 extra banks without any extra paperwork needed. This is a massive time saver.

- You can see all the rates available online and it only takes a few clicks to move the cash around to ensure you are getting optimal rates.

- At the end of the tax year, you will receive one summary showing all the interest for your tax return.

- You can set a limit of £85,000 per institution so you have the confidence of knowing all the cash is 100% protected by the FSCS at all times.

- You will be able to log into the website and see a summary of all your balances and rates at any time.

- If you wish you can contact me to tap into my expertise for guidance on which rates and accounts to choose or self manage.

- My fee for setting up this service will be a fixed amount which should provide excellent value for money. If you require future assistance a similar small sum will be charged to give you further guidance as needed. We have forsaken any payments from Insignis to improve the terms available for clients, so any fee we charge will be invoiced separately.

I need to mention that this service is not accessible for cash ISAs. If this is of interest, please let me know.

Cash Management services and advice is not regulated by the FCA.

Client Portal

Please can I take this chance to ask you to spend 5 minutes registering for my secure client portal. This has some really useful functions built into it namely:

- It will show you a current summary of the value of all your assets. The investments and pensions we advise on have their values updated daily. The portal can also be linked to your bank accounts via open banking and the totals will update daily. You can even link your home to the current value on Zoopla.

- The portal allows us to exchange secure messages and to share documents in a very secure way which is much more reliable than email.

To complete the registration, please visit my website (www.tkgfp.co.uk) and click on the ‘Client Login’ button in the top right corner. You then need to set up a secure password and confirm your email and you will be ready to go. You will be offered the chance to set up 2 factor authentication, but you can skip this step if you wish.

A request for help

Speaking of websites, if you have not already done so, please can I trouble you to leave a positive review of my services on VouchedFor? This only takes a few minutes but is very helpful for new clients to find me. I only need a handful of new reviews to appear in the 2023 Guide to Top Rated Advisers which appears in the national papers, so any support is appreciated. This is the link to use: https://www.vouchedfor.co.uk/financial-advisor-ifa/crawley/028818-tim-gurr/write-review

If you prefer, you can also leave Google reviews for the new firm via this link: https://g.page/r/CZ_sEhT4G7sbEBM/review

Upcoming

I have one eye on the next Autumn Statement which is due on 22 November and will likely be writing shortly afterwards with a summary of anything of note. Let’s hope this year’s statement passes with less of a fuss than Liz Truss’s ill-fated venture last year.

My wife Linda has joined me in the firm and is working on some new literature and guides, so I hope to share these with you in due course. That’s it for this update.

The small print:

The content of this newsletter is for your general information purposes only and does not constitute investment advice. It is not an offer to purchase or sell any particular asset and it does not contain all of the information which an investor may require in order to make an investment decision. Please obtain professional advice before entering into any new arrangement. Although endeavours have been made to provide accurate and timely information, there can be no guarantee that such information is accurate as of the date it is received or that it will continue to be accurate in the future. We cannot accept responsibility for any loss as a result of acts or omissions taken in respect of any articles.