How we work & our fees

What is Financial Planning?

In simple terms, it is understanding your financial situation and your plans for the future and then using my two decades of skills and experience to create a plan to meet all of your needs.

One thing that is certain, once clients have gone through the process with me the benefits are clear.

When we work together we will go through a three-step process.

Initial Consultation

Firstly, our initial meeting takes place remotely, over Zoom or Teams which is non-chargeable. We can also meet in my office near Gatwick airport.

This meeting allows me to introduce myself and how I work and it is your opportunity to tell me about yourself and how you need my help.

If we agree there is value for you in us working together, I will send you a fee agreement to sign to continue the process which begins with a detailed cashflow planning analysis of your current position over 2-3 meetings. This will be for a fixed fee of £1,250 plus VAT (£1,500 in total).

Cashflow planning

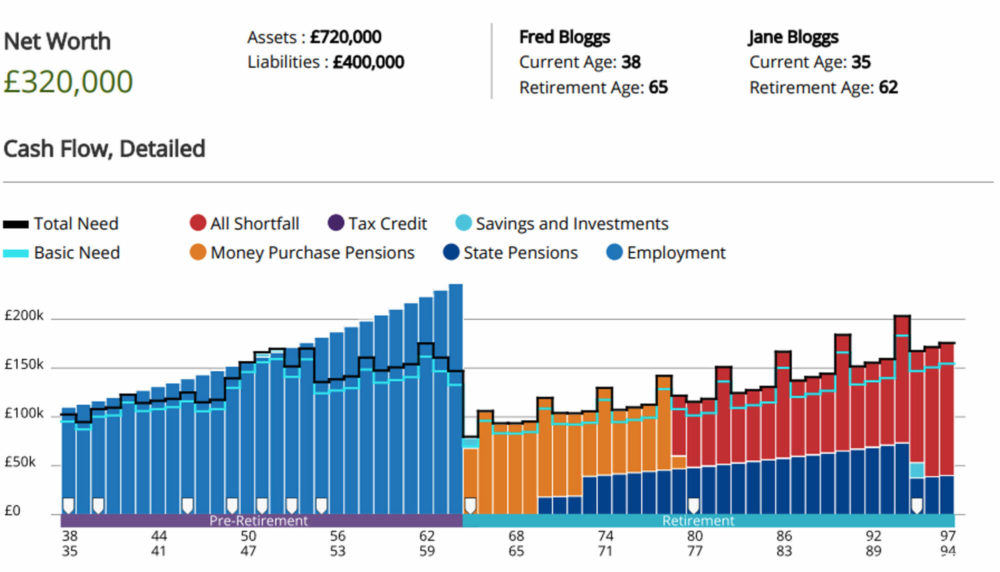

We will then have a further discovery meeting which lasts 1-2 hours for us to really dig down into your circumstances and draw out all of the information we need about your current situation and your plans for the future. I will normally ask you to send me statements for any pensions or investments you have and to obtain a state pension forecast online. If necessary, I will write off to the providers of your pensions and investments for more information at this stage. Once I have all the information I need, I will build a cashflow model based on your circumstances. A cashflow model is simply a visual tool used to create a graphical representation of your assets, investments, debts, income and expenditure. I will then project these forward, year-on-year, to assess the likelihood of you being able to achieve your objectives.

This income and expenditure chart shows a bar for each year of your life (up to age 97), representing your household income, with a different colour for each income element. Your total expenditure is illustrated by the black line running across the bar. Where there is not enough income to cover expenditure, the model assumes you will draw on savings and investments until they run out. The savings and investments chart highlights the impact on your savings and investments over the same period of time. Where you have run out of money is indicated in red.

I have been using this tool with clients for over 12 years and use it because it allows you to “see” your finances and most clients have never looked at their finances in this way. It also allows me to demonstrate in real time how different choices may affect your outcomes.

In this example, the client has a lot of red at the end of the chart indicating they will run out of money in their late 70’s and then be reliant on the state pension alone.

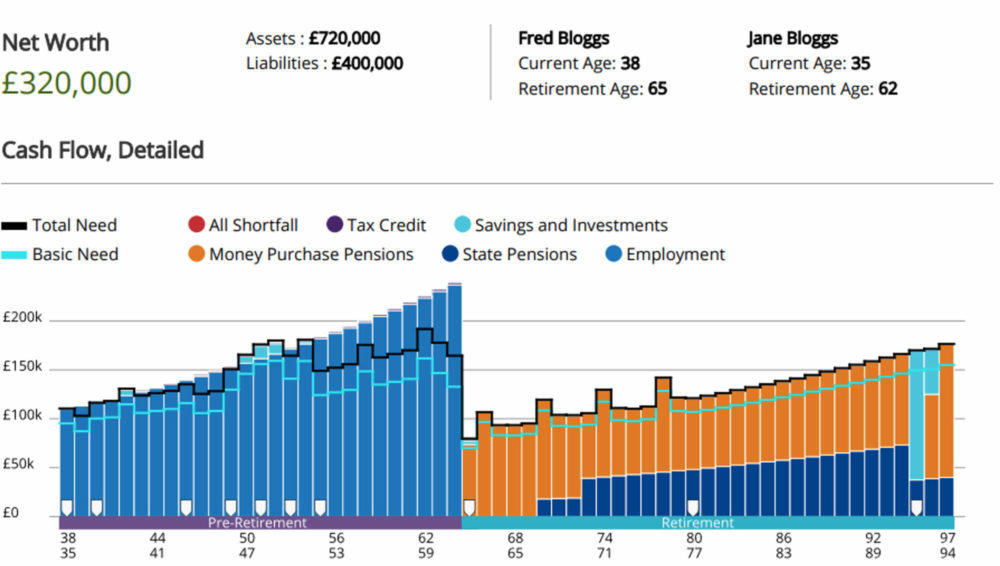

To remedy this, I provided recommendations to boost their savings into their company pensions and also begin saving extra monies into ISAs and this is the difference made to the long-term forecast.

Structuring

Inevitably, clients come to me with lots of pre-existing pensions and investments and ask my advice on how to structure their finances to make the financial plan we have built a reality. As the next stage, I will formally review each of the pensions and investments and advise if they should be retained or switched. As this involves regulated product advice, my fee is 1% of the amount we are advising on, subject to a minimum of £1,250. Therefore, if you had a pension valued at £150,000 my fee would be £1,500 for a review of this. Typically, I will cap this fee at a maximum of £5,000 but this depends on complexity. If you have 13 pensions (like one of my other clients), you might expect to pay more. I need to make it clear that this 1% fee is paying for my time to prepare the report.

The fee will be invoiced on production of the report and is payable whether you decide to implement the advice or not. I do not work on a ‘no win no fee’ basis, nor does any other professional worth their salt.

The fees for this stage are normally VAT exempt.

Ongoing Review

The final stage of the process and most valuable to you in the long-term is to agree a schedule of when to review your financial affairs to keep you on track.

As part of this process, I charge a fee of 0.75% of the amount I am advising on subject to a minimum of £750 per year for my core service. Based on the £150,000 example earlier, this would amount to an annual fee of £1,125. This fee is VAT exempt. We can either invoice you or it can be deducted from the arrangements we advise upon. For single clients or those with partners where the total assets under advice in one name are over £500,000, we will typically reduce this ongoing fee to 0.6% depending on complexity.

In this service, I will monitor the investments I have recommended as part of the structuring process and we will meet at least once a year to go through your circumstances and update your cash flow. We will agree if any changes are necessary. I will then prepare a detailed summary report explaining if any changes are needed and organise all the paperwork. There is no extra cost for providing this report or making changes. I will typically include advice on topping up pensions, ISA funding and capital gains tax funding within the annual fee. There are no hidden dealing fees or commissions applicable.

The only time you would incur an extra cost would be if you asked me to formally review an arrangement that was not under my advice. Again, the fee is typically 1% of the amount under advice but the minimum is £500 as long as I can incorporate the advice in your annual report.

If you need advice on setting up Life Insurance or Protection, you are free to search the internet for the best rates. Alternatively, I can arrange cover for you with minimal inconvenience, but my fee is usually £750 for the first policy and then £500 for each policy thereafter. The fee is normally VAT exempt. I will invoice the fee to you and do not receive or accept commission and will ask the Insurer to reduce the premium to reflect this. The fee is usually much less than the extra cost of a policy with commission over the life of the plan.

For clients with complex needs that may require several meetings per year, I offer a comprehensive service charged at 1% per year subject to a minimum annual fee of £2,500 per client/£3,300 per couple. This service is ideal for clients that are new to taking advice that would prefer a greater level of support in the early years of our relationship.

Example fees

For a client requiring advice on a pension and/or investment valued at £150,000 the costs would be:

| Cashflow Planning Fee | £1,500 |

| Structuring Fee | £1,500 |

| Total Fee | £3,000 (including VAT) |

If ongoing advice is provided our fee of 0.75% would amount to £1,125 per year and this fee is VAT exempt.

For a client that requiring advice on a pension and/or investment valued at £800,000 the costs would be:

| Cashflow Planning Fee | £1,500 |

| Structuring Fee (capped at £5,000) | £5,000 |

| Total Fee | £6,500 (including VAT) |

If ongoing advice is provided our fee of 0.6% would amount to £4,800 per year and this fee is VAT exempt.

For a client requiring advice on a setting up one life insurance policy the costs would be:

| Cashflow Planning Fee | £1,500 |

| One Policy recommendation and implementation | £750 |

| Total Fee | £2,250 (including VAT) |

For a client requiring advice on a setting up two life insurance policies the costs would be:

| Cashflow Planning Fee | £1,500 |

| One Policy recommendation and implementation | £750 |

| Second Policy recommendation and implementation | £500 |

| Total Fee | £2,750 (including VAT) |

It should be noted that the necessity for life insurance or protection policies is typically identified during initial cashflow planning sessions.