Budget Update

March 5, 2021As is customary, I have once again sat down to listen to the Chancellor and followed this up by scouring the Budget documents for the key announcements that will affect my clients. (Our detailed analysis of the major announcements is attached if this of interest).

The obvious good news is that there were no headline catching changes to pension rules announced. This is partial good news and I am pleased that no changes were announced to pension tax relief, the tax free cash sum or the Annual Allowance.

The changes to Corporation Tax rates will mean that pension contributions will become even more attractive for company owners looking to extract profits, so there should be some good planning opportunities here.

It looks like we are all going to be squeezed by the freeze in the tax bands over the next 5 years. It won’t be noticeable initially but if you look at the forecasts of how much this will raise in a few years’ time the sums increase significantly. The Government have potentially left wriggle room to back track if things are looking up before the next election.

No changes to Inheritance tax were announced other than the Nil Rate Bands being frozen for five years. Inheritance tax is largely a voluntary tax and there is much that can be done to blunt its effects with basic planning.

The one change which has stuck in my craw is the freezing of the Lifetime Allowance. To explain why, first a bit of a pensions history lesson is needed (stay awake at the back).

The Lifetime Allowance was introduced as part of the Pensions Simplification measures on 6 April 2006 and began its life at £1,500,000 rising to £1,800,000 from 6 April 2010. The Lifetime Allowance will now be frozen at £1,073,100 until 6 April 2026 at least and the Treasury forecast this will generate the following tax receipts:

2020-2021

-£10,000,000

2021-22

£80,000,000

2022-23

£150,000.000

2024-25

£255,000,000

2025-26

£300,000,000

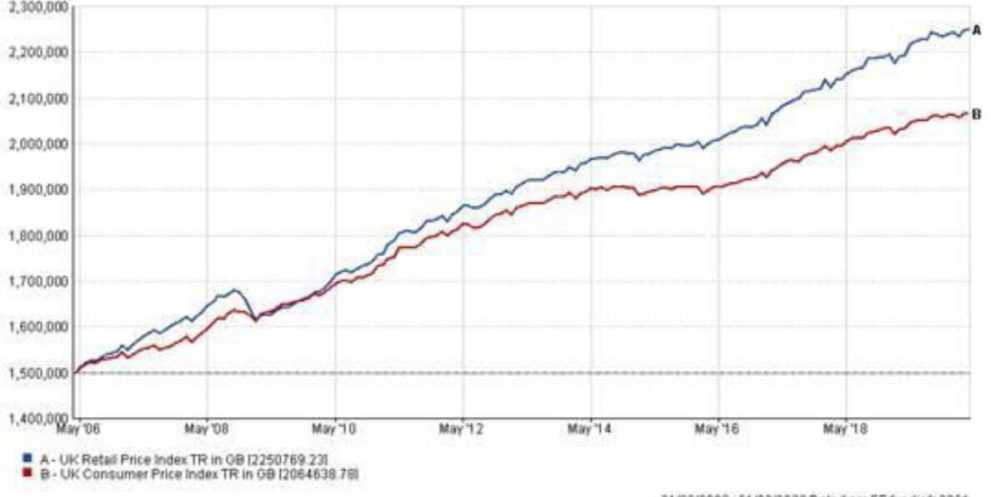

It is worth noting that if the original £1,500,000 was increased by the Consumer Price Index (CPI) which is the lower measure of inflation (cost of living), the Lifetime Allowance of £1,500,000 should today be worth £2,064,638. Even if you started it at £1,000,000 in 2006 it should today be worth £1,376,425. See below:

We now face the situation where in 2026 the Lifetime Allowance will still be capped at £1,073,100. It had been planned that the Lifetime Allowance would have continued increasing by CPI or about c2.5% a year, so it should have been over £1,200,000 by 2026. Putting this in perspective this is now a 50% reduction compared to the Lifetime Allowance in 2006!

It is worth re-iterating that the value of pensions over this threshold is taxed at between 25% and 55%. Many see this as a tax limbo pole to be ducked under. It is a very emotive issue and people will go out of their way to avoid paying this sort of tax, even if they would probably end up being slightly better off by retiring a few years later.

There are many individuals who are heading toward retirement who will be oblivious of this. Even someone with £800,000 now will potentially be caught out with a fair wind of growth in their pension. That’s ignoring any future payments. There are still some potential options available to plan for this but this will be based on individual circumstances, not least working out where individuals are projected to stand against the new limits.

Without getting carried away, this is a colossal raid on pension savings which has largely gone unnoticed, except for perhaps by the British Medical Association who successfully lobbied the Government to raise the Annual Allowance cap.

I am sure there are many people who are struggling to make ends meet that will not give two hoots about this as they will not be personally impacted. My main concern is the unintended consequences, it is not hard to imagine thousands of doctors deciding to go a few years earlier than they planned at a time when their experience will be needed more than ever. I would expect a further brain drain from all professional walks of life.

Is it a bad thing for individuals at the height of their career and earnings to retire several years earlier

and stop paying substantial amounts in income taxes? Answers on a post card…

The small print:

- The content of this newsletter is for your general information purposes only and does not constitute investment advice. It is not an offer to purchase or sell any particular asset and it does not contain all of the information which an investor may require in order to make an investment decision. Please obtain professional advice before entering into any new arrangement. Although endeavours have been made to provide accurate and timely information, there can be no guarantee that such information is accurate as of the date it is received or that it will continue to be accurate in the future. We cannot accept responsibility for any loss as a result of acts or omissions taken in respect of any articles.

- The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

- Thresholds, percentage rates and tax legislation may change in subsequent Finance Acts.