January Update

January 3, 2024Happy New Year! I trust this short missive finds you and your loved ones well.

I am looking forward to 2024 being a better year than we have seen in a while (probably famous last words!).

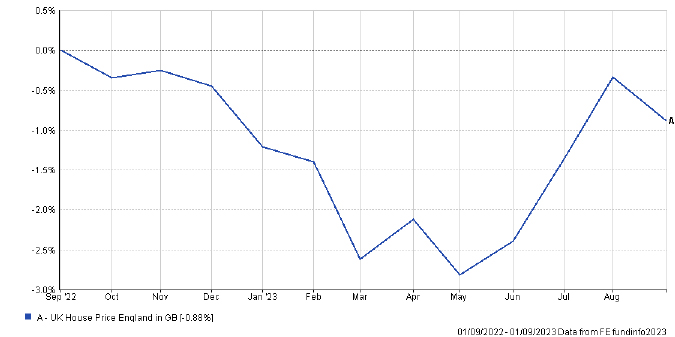

I was looking back at last year’s missive which I sent out around this time. I was interested to see that while house prices dipped by around 3% in May, they apparently made a comeback and are broadly back to where they were as noted below:

As inflation (cost of living) has been failing for a while now, 2024 should be a year of falling interest rates. It has undoubtedly been nice for cash savers to see a return for once, but I do believe rates have peaked and will be reducing from this point to hopefully something in line with the long-term average of around 3%. This will likely take a year or two to play out.

Anyone holding onto cash and looking for a return to or a start in markets might be wise to look at investing before the interest rates are expected to start coming down by the end of spring, as we expect to see a bounce in markets linked to the reductions.

This should mean average risk portfolios with around 40% in bonds should recover a chunk of the falls which have taken place over the last 2 years, and it should present a good entry point for even lower risk portfolios which mainly invest in bonds. Bond prices have an inverse relationship to interest rates, so as interest rates go up, bond values fall and when interest rates go down, bond values go up. Equity market values should also benefit.

Equity investments do not afford the same capital security as deposit accounts. Your capital is at risk. The value of your investment (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance!

We are also waiting for the final legislation on the changes to pensions and Lifetime Allowance which should be finalised in the Spring.

The Lifetime Allowance charge on funds over £1,073,100 is being effectively abolished however, we are having several new allowances being introduced such as the Lump Sum Allowance of £268,275 and the Lump Sum and Death Benefit Allowance of £1,073,100. There are new rules around the tax-free cash sum (known as the Pension Commencement Lump Sum) and how it will be taxed if you go over the Lump Sum Allowance.

I’m not going to bore you with explaining all the permutations, but these new rules do introduce more complication in certain areas and how we decide which pension to take tax free lump sums from. Individuals in defined benefit/final salary schemes will need to exercise particular care in deciding how to take the cash lump sums if they have alternatives.

Individuals with Fixed Protection should also be safe to receive contributions from their employers or pay into their own pensions, but this will be unlikely to generate more tax-free cash in most cases due to the Lump Sum Allowance rules. Although we can only advise based on the rules currently in place, the idea of those with Fixed Protection paying in new contributions still makes me nervous, especially with the potential for a new incoming Government that have set their face against the changes.

With all the activity in the bond markets over the last few years, it has highlighted the shortcomings of pension life-styling options which move you to lower risk bonds as retirement approaches. If you are still working this will be included in your company pensions automatically. This is an area which requires careful thought and planning, as accepting the default outcomes might not align with your plans. These de-risking options turn on around 10 years prior to retirement and go into overdrive in the last 5 years.

As you probably know, retirement planning and Lifetime Allowance planning are my specialist subjects so if you know of anyone planning to retire in the next five years, please do ask them to contact me as these are just a selection of the points to be aware of which may require careful planning.

I am also excited to announce the introduction of my 12 point financial health check process. I am looking forward to going through this with you at our next annual review and I believe this will help to give clients further peace of mind and demonstrate the benefits of using my service.

As a final point, I would like to thank everyone that took the time to leave me a positive review on VouchedFor. I have met the qualifications to be a top rated adviser in 2023 and this will hopefully boost the profile of the firm further.

I will leave it there for now and close by thanking you for your support over the last year. Please can I also wish you and your loved ones a very prosperous 2024!

The small print:

The content of this newsletter is for your general information purposes only and does not constitute investment advice. It is not an offer to purchase or sell any particular asset and it does not contain all of the information which an investor may require in order to make an investment decision. Please obtain professional advice before entering into any new arrangement. Although endeavours have been made to provide accurate and timely information, there can be no guarantee that such information is accurate as of the date it is received or that it will continue to be accurate in the future. We cannot accept responsibility for any loss as a result of acts or omissions taken in respect of any articles.