Christmas Update 2022

December 10, 2022I hope this missive finds you well and full of good Christmas cheer. There has been much negativity about of late, so I wanted to list a few things to feel positive about in this Christmas update so let me start with that.

- The oil price is now lower than it was at the start of the Ukraine conflict and energy prices are falling although energy company will take some time to pass these savings on.

- The headline rates of expected inflation are now starting to come in lower both in the US and the UK which is hopefully indicating that the worm has turned for us all.

- The Russian military have demonstrated that they are largely a spent force so eastern Europe can breathe a sigh of relief although there is still a long way to go for Ukraine (if Putin doesn’t accidentally fall out of a window in the next few months).

- The U.S. Department of Energy officials announced that the National Ignition Facility at the Lawrence Livermore National Laboratory in California finally attained “fusion ignition” – a long-awaited achievement for nuclear fusion researchers around the globe. This basically means they got more energy out than they put in. Expect fusion reactors to be another 20 years away still.

- There has been some successful testing of drugs to delay the onset of Alzheimer’s and even the suggestion that a urine test could be developed to screen for this. Preventative medicine is my prediction for the breakthrough technology of the next two decades. If a company can crack developing affordable regular screening for illness, cancers and disease, expect that company to be the most valuable in the world in 20 years. I may have to change my standard assumption for mortality from 95 to age 100 (much to the horror of clients who say they don’t want to be around that long!)

As I predicted in my note last year, Bitcoin has been in the news after the value crashed by 70% since last November and there has been a scandal with FTX stealing their depositors crypto and spending it as their own money. It is well worth remembering that there is no regulation in this space so it is still very much a case of buyer beware and there is no recourse if things go wrong with this. Contrast this with the regulations that I have to operate under which mount up every year. I will be speaking to you at some point about the new requirements under the FCA’s new Consumer Duty (insert your own remark about the overbearing weight of regulation for your own good here).

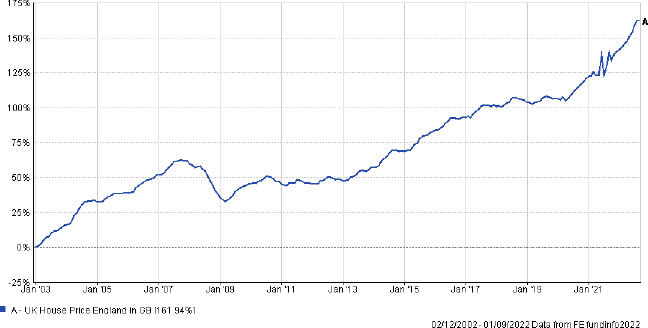

My fears about inflation and rising interest rates turned out to be well founded. We started the year on a Bank of England rate of 0.25% and it is now standing at 3.5% and it is predicted to rise to 5.5%. If it doesn’t reach that high, expect markets to get quite excited about this. I would expect that rates will probably normalise somewhere around 3% over the next few years but most people do not expect rates to go down to 0.25% again. I am old enough to remember my first mortgage rates being around 5% and that being considered a good deal but I suspect rates around this level may become the new normal. I’m sure some of you can recall much higher rates than that! For the first time in as long as I can recall it looks like house prices may drop a bit over the next year. I will throw my hat in the ring and estimate they will fall by 5% based on the index below. Send me your prediction and I will give a bottle of wine to the closest guess for the 2023 calendar year.

As you will probably have heard from me, markets are largely driven by sentiment and there has certainly been a lack of positivity over the last year. As we are now starting to see indications that inflation is falling a bit faster than expected this should hopefully be a shot in the arm for portfolio performance.

On the subject of scams, I was very upset to hear from several clients over the last year who have unwittingly become victims of fraud on their bank accounts by transferring their money to fraudsters. I would like to address this directly with a few easy to implement tips to reduce the chances of you becoming a victim of a scam.

Firstly, do not engage with anyone that phones or emails you out of the blue. Scammers can use technology to disguise where they are calling from or pretend to be calling from any number they wish to use including your bank. If you use social media, make sure you lock your account so that only friends can see your information. Google yourself and check what information is online about you and take steps to remove anything sensitive, your personal email or date of birth for example.

If you receive a call from your bank always hang up and re-dial using the telephone number on the back of your card or the bank’s website. Never disclose any of your personal details or comply with a security check if anyone has contacted you. Any legitimate caller will be happy for you to hang up and re-dial.

If you receive a request to transfer money to a friend/family member, pick up the phone and call the person requesting the transfer and make sure it is a genuine request. It is easy to impersonate someone else online so beware.

If you receive a text or email, never ever click the links! Only ever access your bank accounts by logging into your account in the usual way via your phone/computer.

Recommended steps:

- Ensure your telephone number is ex Directory. You can call your phone company to request this.

- When completing forms always tick the do not contact me box.

- Join the Telephone Preference Service which adds you to a do not call register. You can register here: https://www.tpsonline.org.uk/.

- Join the Mailing Preference Service (MPS) which is a register for individuals who wish to stop personally-addressed marketing material being sent to them. To register, please visit www.mpsonline.org.uk

- Add a PIN code to your mobile phone SIM card. This is easy to do and helps prevents your phone being cloned by scammers to access your bank account apps if it is ever lost or stolen. Google how to do this for your make and model of phone. Most phones have a default PIN set in the factory such as 1234 or 1111 but make sure you change this.

Without wishing to make you cynical, doubt anyone that calls or emails you. We are mostly clever enough to avoid the Nigerian prince needing your bank details or fake lottery wins. Scammers are very sophisticated now so ignore any money-making schemes.

Please bear in mind that nobody from your investment provider will ever call you unannounced or ask for your bank details over the phone. Nor will anyone from my office.

You have my mobile phone number (07850 171494). If you have any calls or contacts, you are unsure of, please call me immediately. I am always happy to hear from you if you have any concerns at any time. I am never usually more than a few feet from my phone so leave me a message and I will call you back that day.

If you have been the victim of a scam or fraud, please report it to https://www.actionfraud.police.uk/. This will potentially help the police to stop others being targeted.

It is also worth re-stating that I will never ask you to write a cheque or send monies to my firm other than in settlement of a previously agreed invoice. Your monies will always be held separately in your name with a safe custodian and they have multiple layers of security to prevent fraud. Most of them boast that they have never been duped by scammers and they maintain substantial amounts of insurance and would be liable to offer you redress in the event of an issue. The monies I advise my clients upon are subject to the highest level of fraud protection we can obtain.

As I mentioned last year, I rarely do any form of marketing because most of my new clients are referred by my existing clients, but if you know of anyone that may benefit from my advice please do forward on this email or ask them to drop me a line.

If you have been pleased with the advice you have received from me, it is also very helpful to me if you can leave a positive review on my VouchedFor page. If you wouldn’t mind sparing 5 minutes to leave a review of my services, it would be greatly appreciated. To do so, please click this link (I promise this one is safe!):

https://www.vouchedfor.co.uk/financial-advisor-ifa/croydon/028818-tim-gurr/write-review All that is left is for me to wish you and your family a very happy Christmas and I look forward to working with you in 2023!

The small print:

- The content of this newsletter is for your general information purposes only and does not constitute investment advice. It is not an offer to purchase or sell any particular asset and it does not contain all of the information which an investor may require in order to make an investment decision. Please obtain professional advice before entering into any new arrangement. Although endeavours have been made to provide accurate and timely information, there can be no guarantee that such information is accurate as of the date it is received or that it will continue to be accurate in the future. We cannot accept responsibility for any loss as a result of acts or omissions taken in respect of any articles.

- The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

- Thresholds, percentage rates and tax legislation may change in subsequent Finance Acts.